“The Constitution is not a mere lawyer’s document. It is a vehicle of life and its spirit is the spirit of ages.”

-Dr. B. R. Ambedkar

Also Known as the longest-written national constitution in the world, the Constitution of India lays down the framework that demarcates the fundamental political code, structure, procedures, powers, and duties of government institutions and sets out fundamental rights, and duties of citizens. To ensure constitutional autochthony, its framers repealed prior acts of the British parliament in Article 395.

The original 1950 constitution is preserved in a nitrogen-filled case at the Old Parliament House in New Delhi.

But that’s exactly not what’s made the headlines! It is the Constitution of India’s small coat pockets size edition. Originally launched in 2009, the coat pocket edition was designed for easy portability and use in legal settings. Bound in flexi-foam leather, and printed in imported bible paper, it has always been adorned by the legal fraternity. One can even find it in an evolved Indian household, kept as a souvenir. Currently, the latest 17th edition is available with the 106th Amendment incorporated.

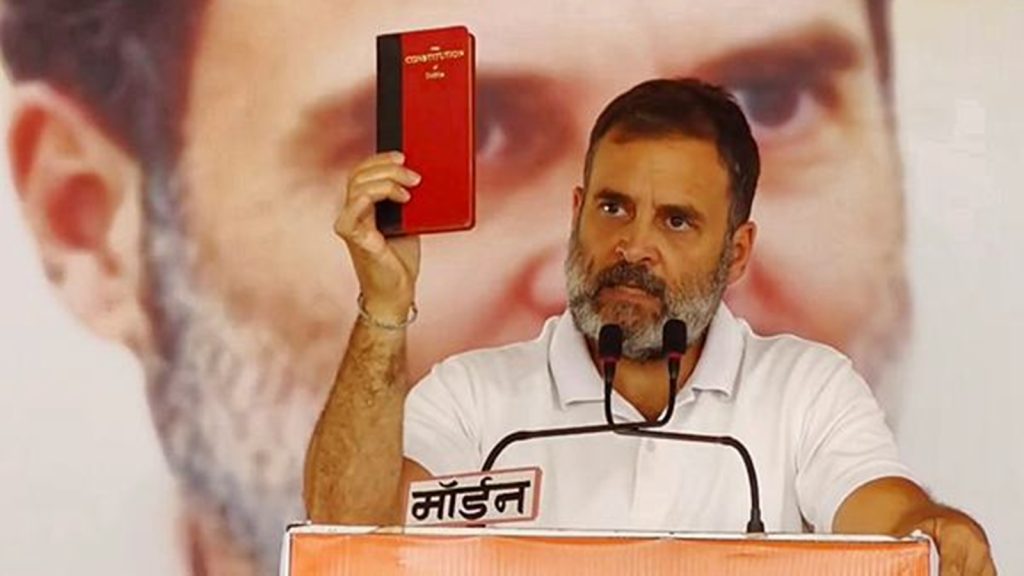

This edition gained popularity during the Lok Sabha elections 2024, notably because Congress MP Rahul Gandhi, then many other congress members, prominently used it in their campaign rallies. This exposure led to a sudden surge in its already high-demand status. (The News Minute).

Eastern Book Company holds the intellectual property rights to this edition, ensuring its exclusive publication and distribution. The coat pocket edition is also a favoured gift by senior judges travelling abroad and is available in numerous libraries worldwide (Hindustan Times) (IndiaWest Journal News)

The edition is particularly notable for:

- Portability: Its compact size makes it convenient for on-the-go reference.

- Comprehensive Content: Despite its small size, it includes the full text of the Constitution along with relevant amendments.

- High-quality Printing: Despite being a ‘little-book’ the edition does not compromise on print quality. The text is clear and legible, printed on Bible paper that withstands regular use and long shelf life.

- Practicality: It addresses the need for a portable version that can be used in courtrooms, classrooms, or even for personal study.

The smartest way to get your original copy is to buy from EBC Webstore, EBC’s home-grown e-commerce marketplace to buy law books, magazines, databases, journals etc. This will ensure the authentic copy reaches you in the minimum time possible and with secured payment methods.